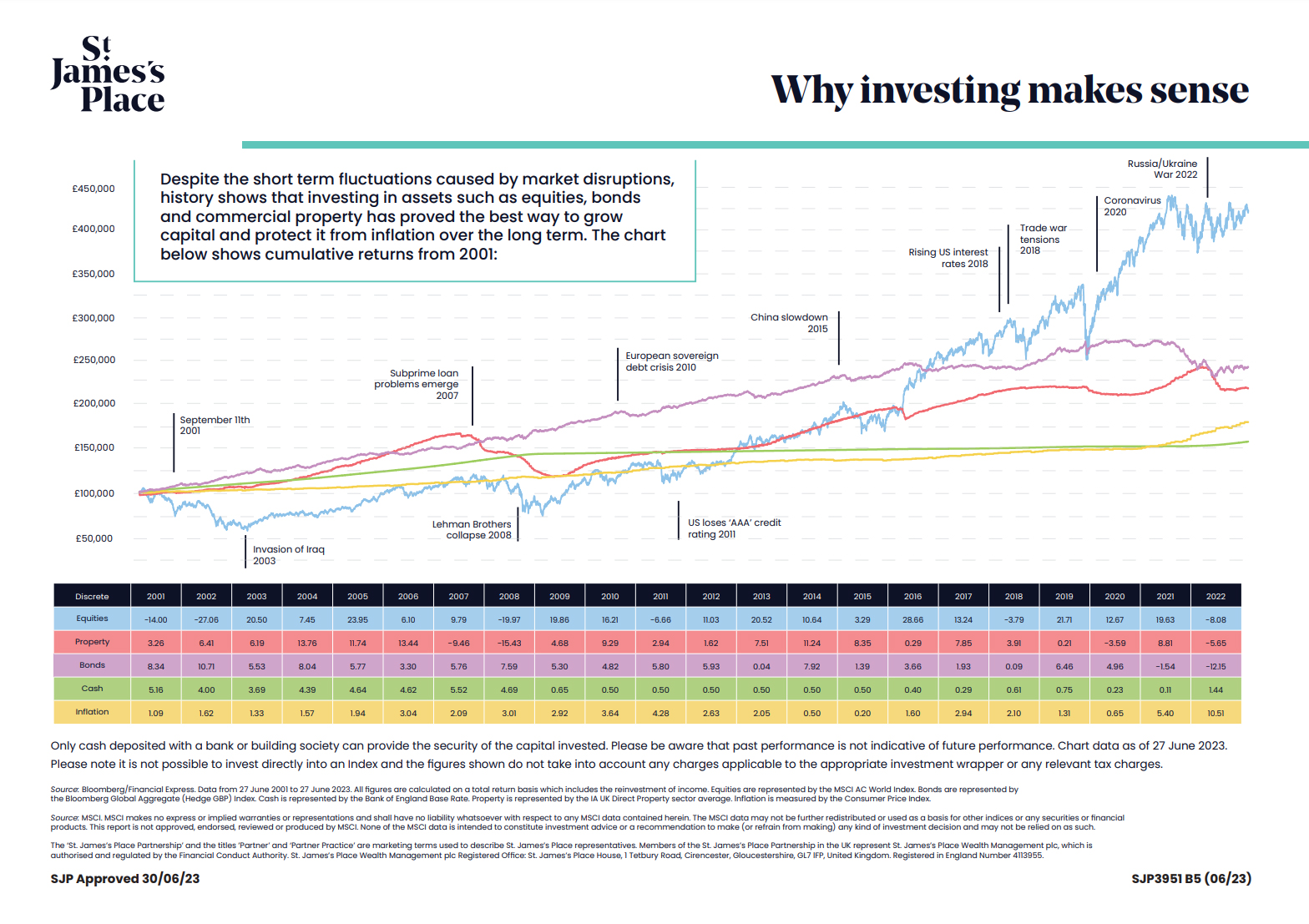

The attached chart provides an insightful illustration of investment outcomes over the last 22 years. If, hypothetically, you had invested £100,000 into your pension back in 2001, the growth by June 2023 would be quite significant, and heavily influenced by the nature of the asset class chosen. For those brave souls who chose to venture into the higher-risk realm of equity markets, their investment could have burgeoned to over £400,000.

On the other hand, those who favoured the relative stability of real estate would see their investment double to a little over £200,000. Investors who took the path of bonds would fare slightly better, with their investment growing to just under £250,000. A more conservative approach of holding cash would yield a modest return, pushing the initial investment to just above £150,000.

It’s important to note that market volatility has been quite pronounced of late, but as the chart demonstrates, significant returns are possible over the long term across different asset classes. Furthermore, the accompanying tax benefits should not be overlooked when considering the overall value of these investments.

Residential Mortgage

Commercial Mortgage

Pensions & Investments

Protection & Insurances

Health Questionairre

Asset Finance

Business Finance

Invoice Finance

Residential Mortgage

Commercial Mortgage

Personal Details Form

Business Details Form

Tax Return Information

Residential Mortgage

Commercial Mortgage

Pensions & Investments

Protection & Insurances

Health Questionairre

Asset Finance

Business Finance

Full Business Finance Review

Invoice Finance